While sitting at the bar in my local pub enjoying a frosty pint with the day’s news streaming over the TV in front of me, CBS news anchors announced that thanks to Fannie Mae and Freddie Mac, those of us with high credit scores interested in buying real estate, will pay higher interest rates than those who try to do the same thing with low credit scores.

I nearly blew froth across the bar as I choked on my beer.

At first I thought it was a joke, or I misheard the TV, but after hearing a few patrons next to me mumble “WTF”, and doing some research, sadly, the news is true.

Upon further research, Fannie Mae and Freddie Mac have released a new Loan–Level Price Adjustment (LLPA) Matrix for mortgages that are sold to them after May 1, 2023.

According to this new LLPA, borrowers with high credit scores will pay higher mortgage fees than they would have had to pay previously, and those with lower credit scores will pay lower fees.

David Stevens, a former federal housing commissioner and former CEO of the Mortgage Bankers Association, told the New York Post:

“It’s unprecedented…my email is full from mortgage companies and CEOs [telling] me how unbelievably shocked they are by this move.”

While the increase wouldn’t be significant – example, on a $400,000 mortgage, the additional fee paid per month would probably come in at about $40.00 – still, it’s the principle of the matter.

According to the New York Times:

Under the new rules, high-credit buyers with scores ranging from 680 to above 780 will see a spike in their mortgage costs – with applicants who place 15% to 20% down payment experiencing the biggest increase in fees….

LLPAs are upfront fees based on factors such as a borrower’s credit score and the size of their down payment. The fees are typically converted into percentage points that alter the buyer’s mortgage rate.

Under the revised LLPA pricing structure, a home buyer with a 740 FICO credit score and a 15% to 20% down payment will face a 1% surcharge – an increase of 0.750% compared to the old fee of just 0.250%….

Meanwhile, buyers with credit scores of 679 or lower will have their fees slashed, resulting in more favorable mortgage rates. For example, a buyer with a 620 FICO credit score with a down payment of 5% or less gets a 1.75% fee discount – a decrease from the old fee rate of 3.50% for that bracket.

But the best quote had to have come from Federal Housing Finance Agency Director, Sandra L. Thompson:

“another step to ensure that [Fannie Mae and Freddie Mac] advance their mission of facilitating equitable and sustainable access to home ownership.”

History of Average Credit Scores in the U.S.

Historically speaking, the higher your credit score, the greater purchasing power you had due to lower interest rates. Lending institutions look at your credit score in order to determine how…faithful and responsible you are at paying back loans.

According to the FICO model of credit scoring, credit scores fall into six categories:

- Very poor: 300-579

- Poor: 580-669

- Fair: 601-660

- Good: 670-739

- Very good: 740-799

- Exceptional: 800-850

But credit scores can vary depending on location and age group. For the purpose of our argument, we’ll take a look at the average credit score in the U.S. over the last decade.

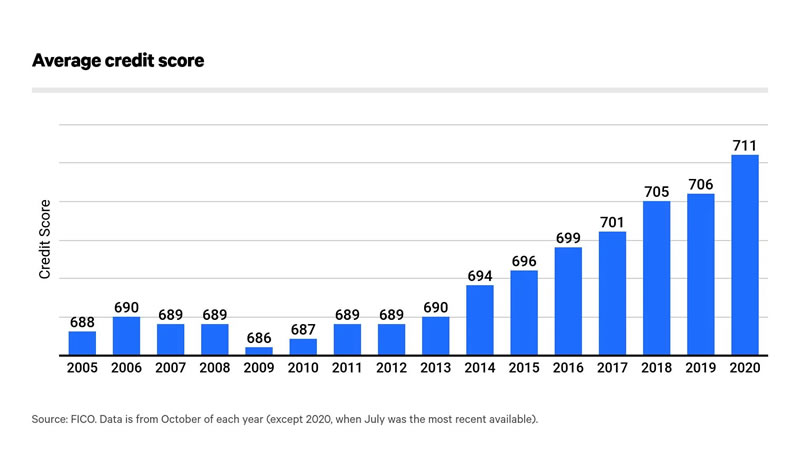

According to Business Insider, the average FICO credit score in the US is 714 as of April 5th, 2023. With the exception of last year, the graph below shows the trend over the last decade:

So, after taking a look at the increasing average credit score over the last 10 years, I’m a little shocked. I expected the scores to be lower, but it would make sense that over the last few years, the average American’s credit score would increase due to the results of the COVID pandemic.

So, after taking a look at the increasing average credit score over the last 10 years, I’m a little shocked. I expected the scores to be lower, but it would make sense that over the last few years, the average American’s credit score would increase due to the results of the COVID pandemic.

At first, I was infuriated by Fannie Mae and Freddie Mac wanting to “advance their mission of facilitating equitable and sustainable access to home ownership” for those who may have an inability to pay their bills on time, or just general financial irresponsibility.

But, considering the average credit score in the U.S. is currently hitting 714 and has been steadily climbing over the last decade, the Feds have a different method to their madness. “We could make more money off those with higher credit scores than we can off those that have a credit score below 680!”

So, tell us what you think below!

Is this the Biden Administration’s way of making it easier for financially irresponsible people to afford housing on the backs of those who have little debt and are financially responsible, or it just another way for financial institutions to rape the greatest majority of their customers like they’ve done for so many years now?